You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Escassez mundial de ICs em 2021

- Autor do tópico Nemesis11

- Data Início

@Julius Cesar

Por cá tens uma promoção parecida. Ryzen 5 5500 descontado a 100€ e depois é escolher uma board por 50-70€.

Por cá tens uma promoção parecida. Ryzen 5 5500 descontado a 100€ e depois é escolher uma board por 50-70€.

Julius Cesar

Power Member

Não há fome que não dê em fartura. Montes de material e o pilim é que vai ser pouco...

Não teria assim tanta certeza, o que não tem faltado é vários lockdowns na China

ASE Breaks Ground on New Chip Assembly and Testing Facility in Penang, Malaysia

https://www.businesswire.com/news/h...embly-and-Testing-Facility-in-Penang-MalaysiaAdvanced Semiconductor Engineering, Inc. (ASE, a member of ASE Technology Holding Inc, NYSE: ASX, TWSE: 3711) hosted a groundbreaking ceremony today for the construction of a new semiconductor assembly and testing facility in Penang, Malaysia. The new facility at ASE Malaysia (ASEM) will comprise 2 buildings (Plants 4 and 5) with a built-up area of 982,000 square feet, located in the Bayan Lepas Free Industrial Zone.

Bodygard

Folding Member

Com uma possível recessão mundial à porta, a procura vai-se reduzir substancialmente...aliás já está a acontecer. Com a procura a reduzir-se (mining no crypto a reduzir-se substancialmente), vai haver componentes com força para venda, oferta maior. Com isso os preços vão ter de descer como já se está a ver.

Hmm...

e aparentemente a TSMC atrasou, até ver ainda não cancelou a expansão 7nm, mas vai continuar a expansão da Fab a 28nm

e aparentemente a TSMC atrasou, até ver ainda não cancelou a expansão 7nm, mas vai continuar a expansão da Fab a 28nm

Semiconductors Down in 2nd Half 2022

https://semiwiki.com/semiconductor-services/321070-semiconductors-down-in-2nd-half-2022/

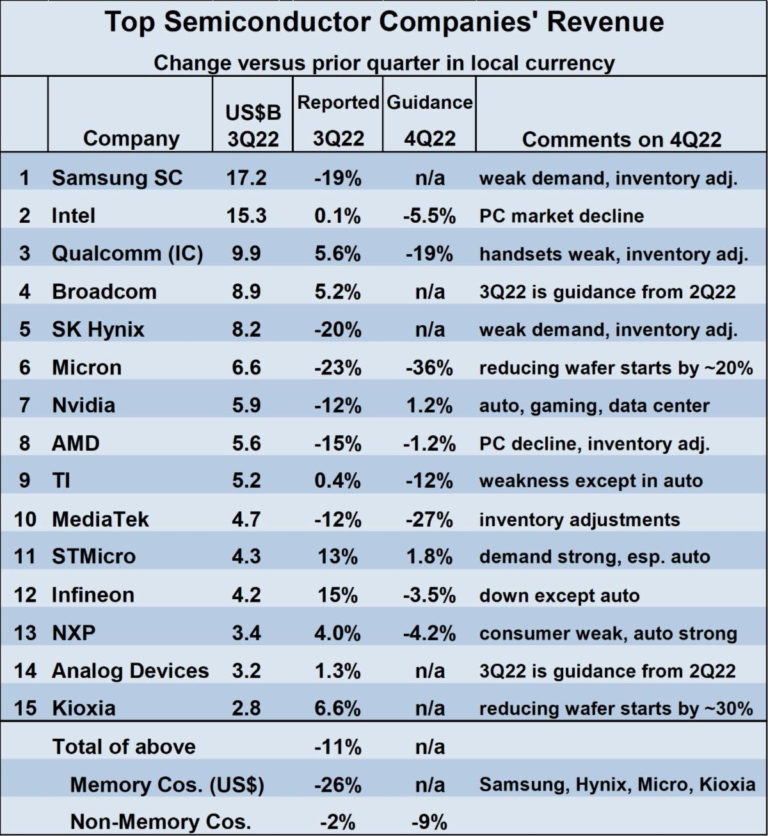

The semiconductor market declined 6.3% in 3Q 2022 from 2Q 2022, according to WSTS. Based on the outlook for 4Q 2022, the second half of 2022 will be down over 10% from the first half of 2022. The 2H 2022 decline will be the largest half-year decline since a 21% drop in the first half of 2009 versus the second half of 2008 during the great recession.

https://semiwiki.com/semiconductor-services/321070-semiconductors-down-in-2nd-half-2022/

Já que se fala da indústria de semi-condutores aqui, dêm uma vista de olhos neste artigo:

How did TSMC get so good?

There is no simple answer, but we think there are a few factors that really stand out...

By now, we are all familiar with the fact that TSMC is, by far, the most capable semiconductor manufacturer in the world, with all the entails for the industry and geopolitics. And as this reality sets in, many people have been asking us how did they get so good?

https://www.techspot.com/news/97011-how-did-tsmc-get-good.html

Explainer: What is Chip Binning?

Hitting the Silicon Lottery Jackpot

You just bought a new CPU or graphics card, and fired it up in your PC. It seems to run pretty cool, so you try a bit of overclocking. The gigahertz climb higher and higher, and it looks like you've got yourself something special. It's surely not supposed to be like this?

So you rush to the internet to share your excitement of hitting the silicon jackpot, and within a few posts, somebody proclaims that you've got yourself "a binned chip".

...

https://www.techspot.com/article/2039-chip-binning/

Raen

Power Member

Não há fome que não dê em fartura...

Semiconductor Bear Market Rally? – Inventory Analysis Of 71 Companies Over 25 Years

Our analysis points to a downturn far worse than companies in the industry and Wall Street expected. Inventory will not reach normalized levels in Q2 2023 as most wish due to record high inventory levels. These inventory levels exceed prior downturns, such as the 2008 Financial Crisis and the Dot-com bubble in 1999-2000.

https://www.semianalysis.com/p/semiconductor-bear-market-rally-inventoryToday we want to dive into the semiconductor industry's inventory levels for the largest 71 companies over the last 25 years. These 71 companies represent all aspects of the supply chain, including equipment, memory, foundry, IDM, fabless design, mobile, RF, OSAT, power semiconductors, and systems. We will include our raw at the end of this report.

Parece que é desta.

EU Proceeds with $47 Billion European Chips Act

A ver no que isto dá.

Mas tendo em conta que para a maioria das empresas da área de semi condutores europeias não usa processos de fabrico avançados....

Uma notícia de uns dias antes dava conta de a Robert Bosch, estar a analisar um investimento conjunto com a TSMC...

TSMC could partner with Bosch for 28nm fab in Germany

Mesmo dando de barato que o "grosso" da produção da Bosch seja o da Bosch Sensortec, ou seja, o sector dos "MEMS" para fornecer internamente o Grupo, com o restante a ser o sector automóvel, que será o mesmo caso da NXP, sendo o caso da Infineon ligeiramente diferente, por causa do sector dos "Power IC" que "exige" um tipo de fabrico diferente do tradicional, mas a maioria do volume destas empresas não exige "fabrico de ponta".

EU Proceeds with $47 Billion European Chips Act

"We have a deal on EU #ChipsAct," Thierry Breton, European Commissioner on internal markets tweeted. "In a geopolitical context of de-risking, Europe is taking its destiny into its own hands. By mastering the most advanced semiconductors, EU will become an industrial powerhouse in markets of the future."

https://www.tomshardware.com/news/eu-proceeds-with-47-billion-european-chips-act"The European vision to double our global market share by 2030 to 20%, and produce the most sophisticated and energy-efficient semiconductors in Europe, is already attracting substantial private investment," Breton said in a statement published by Bloomberg. "Now we are mobilizing considerable public funding and the regulatory framework to turn this vision into reality."

A ver no que isto dá.

Mas tendo em conta que para a maioria das empresas da área de semi condutores europeias não usa processos de fabrico avançados....

Uma notícia de uns dias antes dava conta de a Robert Bosch, estar a analisar um investimento conjunto com a TSMC...

TSMC could partner with Bosch for 28nm fab in Germany

A TSMC fab in Germany targeting a 28nm process is a less advanced development than previously expected – but also a more affordable one (see TSMC’s Dresden fab talks reach advanced stage, says report). While targeting 28nm could go some way to addressing security of automotive chip supply – an issue that got Germany’s attention during the pandemic crisis – it would do nothing for European strategic security and the region’s ability to manufacture at the leading-edge.

https://www.eenewseurope.com/en/tsmc-could-partner-with-bosch-for-28nm-fab-in-germany/TSMC may be negotiating separately about bringing more advanced process technology to Germany; earlier reports referenced the introduction of 12nm manufacturing process (see TSMC mulls building a 12nm Dresden fab).

Mesmo dando de barato que o "grosso" da produção da Bosch seja o da Bosch Sensortec, ou seja, o sector dos "MEMS" para fornecer internamente o Grupo, com o restante a ser o sector automóvel, que será o mesmo caso da NXP, sendo o caso da Infineon ligeiramente diferente, por causa do sector dos "Power IC" que "exige" um tipo de fabrico diferente do tradicional, mas a maioria do volume destas empresas não exige "fabrico de ponta".

Os fundos estão disponíveis, o European Chip Act eram quase 50B, ali estão apenas 5, e fica a faltar eventualmente a FAB da Intel.

EDIT: em relação aos fundos

https://www.eetimes.com/9-governments-set-to-fund-new-localized-chip-fabs/

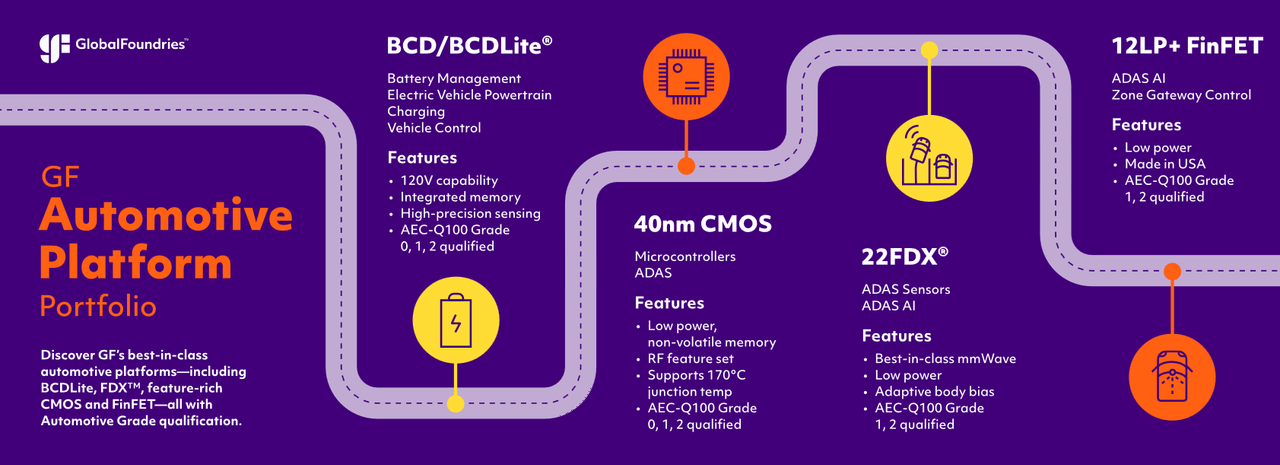

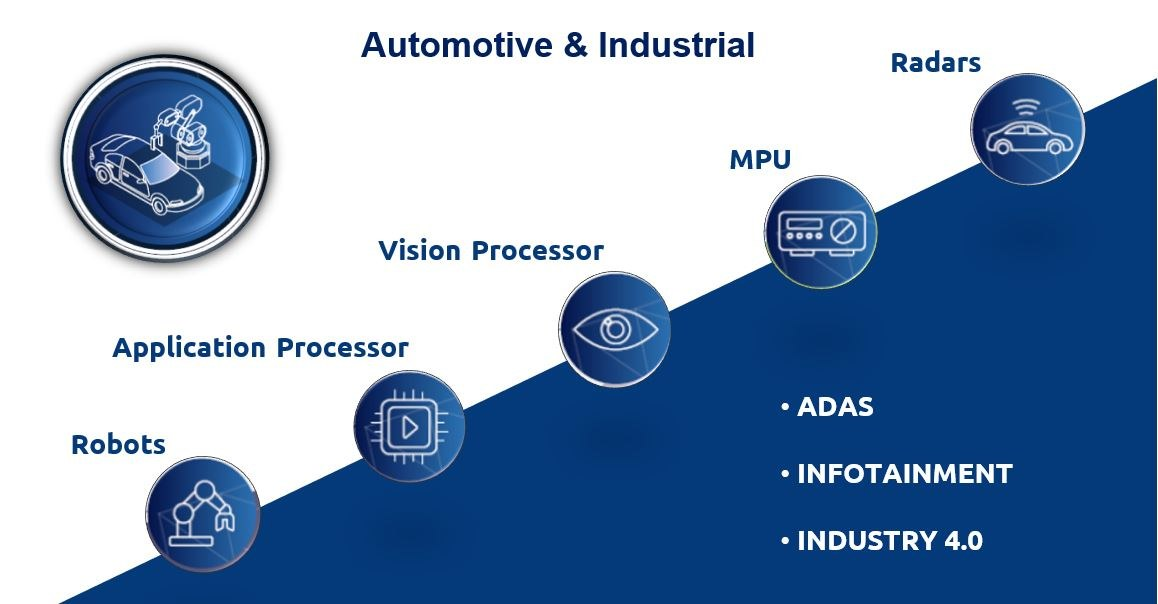

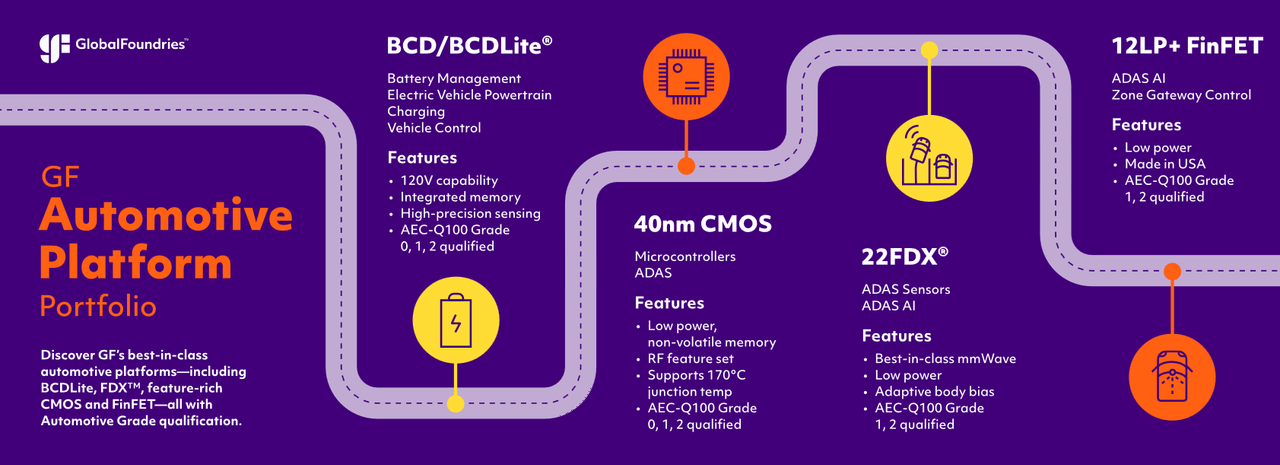

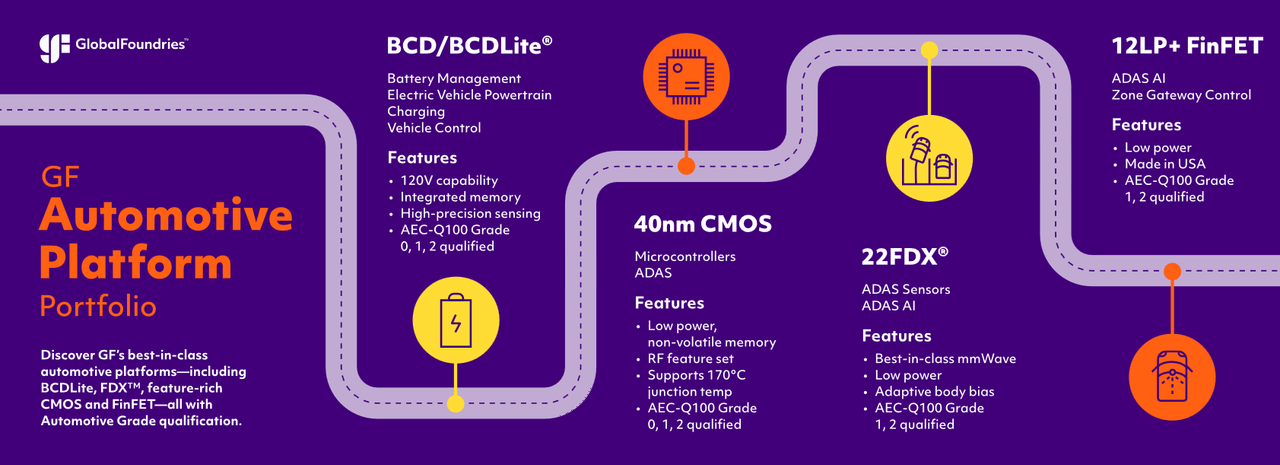

Mas parece claramente uma oportunidade perdida para a GF, que poderia aqui dar o "salto", até porque aquela em particular é para os 28/22nm e 16/12nm

https://www.anandtech.com/show/18912/top-10-foundries-see-revenue-drop-nearly-15-yearoveryear

e a GF não só tem os 28nm (planar) e 14nm (FinFET) qualificados para os mercados alvo (auto e industrial) como até tinha ainda a vantagem de oferecer a alternativa ao CMOS, via "aquisição" da IBM Semi, o "FDX" (FD-SOI) que usando wafers específicas, tem como principal fornecedor os franceses da SOITEC.

https://gf.com/pull-ahead/

https://www.soitec.com/en/products/auto-fd-soi

Quer a Bosch quer a Infineon têm estado a investir bastante na sua capacidade própria mas numa vertente bastante específica, SiC (Silicon Carbide).

depois de terem anunciado a expansão da Fab em Dresden

e há dias também inciaram um novo centro de testes/acabamento na Malásia

EDIT: em relação aos fundos

9 Governments Set to Fund New, Localized Chip Fabs

- China: $143 billion—China considered $143 billion in chip-industry subsidies, according to Reuters. However, Bloomberg reported in January that the plan was on hold.

- European Union: $47 billion—The EU will allocate $47 billion in government investments under the European Chips Act, which is expected to attract $16 billion in private money: $9 billion in state aid, triggering $15 billion in private investment in the IPCEI on Microelectronics and Communications Technologies. The Chips Act and IPCEI are to address semiconductor shortages and strengthen Europe’s technological leadership. The Chips Act’s goal is to double the EU’s share of the global chips market by 2030, from 10% to 20%.

- India: At least $922 million—Semicon India aims to provide financial support to companies investing in semiconductors, display manufacturing and the design ecosystem to facilitate India’s growing presence in global electronics supply chains. The program is to provide financial support of 50% of project costs to new business units or expansion/modernization/diversification of an existing unit.

- Japan: Unspecified amount of at least $6.5 billion—The Act on Promotion of Economic Security by Integrated Implementation of Economic Measures, a.k.a. the Economic Security Promotion Act, in part allocates funds for development of cloud technology, with an eye toward A.I., and supporting the semiconductor supply chain. The Japanese government hasn’t publicly said how much subsidy money it will provide. However, on June 16, Japan’s minister of economy, trade and industry said subsidies of about $391 million will be given for eight projects, including subsidies of up to $126 million to Shinko Electric Industries, a manufacturer of semiconductor package substrates, and support totaling up to around $48 million to Sakura internet for its cloud programs. In addition, TSMC’s new $8.6 billion chip fab in Japan will receive a subsidy accounting for 40% of the cost ($3.44 billion), according to a Foreign Policy Rapidus will get a subsidy worth about $2.5 billion, according to a Reuters report.

- Malaysia: Unspecified amount—Malaysia offers a range of tax and other incentives for foreign investment in manufacturing and priority sectors, such as semiconductors, according to the U.S. Congressional Research Service. The government offers companies in priority sectors a five-year, partial income tax exemption on 70% of their statutory income. Approved high technology companies in priority sectors have a full tax exemption for as long as 10 years. The government provides allowances for re-investments and many other infrastructure and related benefits tied to specific investment zones.

- Singapore: $19 billion—Minister of State for trade and industry Low Yen Ling told the Singapore Semiconductor Industry Association in July the government will invest over a five-year period in emerging semiconductor technology and R&D, in accordance with its Electronics Industry Transformation Map. In addition, Singapore is trying to entice TSMC to scrap plans to build a 12-inch wafer fab in Europe in favor of a Singaporean location, DigiTimes Asia

- South Korea: Unspecified amount—The Act on Restriction of Special Taxation focuses on tax breaks for industries that make improvements to their facilities, including semiconductor companies. Nicknamed the K-Chips Act, the legislation offers a 15% tax credit to conglomerates. Small and medium-size businesses qualify for a 25% tax credit.

Mas parece claramente uma oportunidade perdida para a GF, que poderia aqui dar o "salto", até porque aquela em particular é para os 28/22nm e 16/12nm

https://www.anandtech.com/show/18912/top-10-foundries-see-revenue-drop-nearly-15-yearoveryear

e a GF não só tem os 28nm (planar) e 14nm (FinFET) qualificados para os mercados alvo (auto e industrial) como até tinha ainda a vantagem de oferecer a alternativa ao CMOS, via "aquisição" da IBM Semi, o "FDX" (FD-SOI) que usando wafers específicas, tem como principal fornecedor os franceses da SOITEC.

https://gf.com/pull-ahead/

https://www.soitec.com/en/products/auto-fd-soi

Quer a Bosch quer a Infineon têm estado a investir bastante na sua capacidade própria mas numa vertente bastante específica, SiC (Silicon Carbide).

Infineon to build the world’s largest 200-millimeter SiC Power Fab in Kulim, Malaysia, leading to total revenue potential of about seven billion euros by the end of the decade

https://www.infineon.com/cms/en/about-infineon/press/press-releases/2023/INFXX202308-140.htmlMunich, Germany – 3 August 2023 – The decarbonization trend will result in strong market growth for power semiconductors, in particular those based on wide bandgap materials. As a leader in Power Systems, Infineon Technologies AG (FSE: IFX / OTCQX: IFNNY) is now taking a further, decisive step to shape this market: By significantly expanding its Kulim fab – over and above the original investment announced in February 2022 – Infineon will build the world’s largest 200-millimeter SiC (silicon carbide) Power Fab.

depois de terem anunciado a expansão da Fab em Dresden

Infineon kicks off new Fab in Dresden; Completion planned for 2026; Smart Power Fab will generate 1,000 new jobs

https://www.infineon.com/cms/en/about-infineon/press/press-releases/2023/INFXX202302-058.htmlMunich, Germany – 16 February, 2023 – Infineon Technologies AG (FSE: IFX / OTCQX: IFNNY) is starting construction of its new plant for analog/mixed-signal technologies and power semiconductors. After extensive analysis, the Infineon Management Board and supervisory bodies gave the green light for the Dresden site.

Rising demand for SiC chips: Bosch plans to acquire U.S. chipmaker TSI Semiconductors

26.04.2023 Press releasehttps://www.bosch-presse.de/presspo...-u-s-chipmaker-tsi-semiconductors-253824.htmlPlans to invest 1.5 billion USD in strategically important semiconductor business for electromobility

- Bosch chairman Dr. Stefan Hartung: “With this planned investment in the U.S., we are also increasing our semiconductor manufacturing, globally.”

- Third pillar for semiconductor business: following Reutlingen and Dresden in Germany, Bosch will in the future also make chips in Roseville, California.

- More chips: with the planned acquisition, Bosch will significantly expand its global portfolio of SiC semiconductors by the end of 2030.

- Electric cars as the driving force: SiC chips enable greater range and more efficient recharging.

e há dias também inciaram um novo centro de testes/acabamento na Malásia

Bosch opens new semiconductor test center for chips and sensors in Malaysia

01.08.2023 Press release

350-million-euro investment by the middle of the next decade to strengthen global semiconductor supply chain

- Fully connected test center in Penang creates additional capacity for Bosch to meet continued growth in chip demand.

- Dr. Stefan Hartung: “The expansion of our semiconductor business is strategically very important for Bosch.”

- New test center includes more than 18,000 square meters of clean rooms, office space, and R&D laboratories for up to 400 associates.

- Bosch continues to invest in its worldwide semiconductor manufacturing network in Germany, the U.S., and Malaysia.

https://www.bosch-presse.de/presspo...for-chips-and-sensors-in-malaysia-256640.htmlThe frontend is where the actual circuits are attached and patterned on the wafers; at Bosch, for example, this work is currently performed in the clean rooms of the wafer fabs in Reutlingen and Dresden. The backend is where the individual chips are then separated from the wafers, assembled, and tested. Bosch currently carries out most of the final testing of its semiconductors in Reutlingen, Germany; Suzhou, China; and Hatvan, Hungary. Those locations will now be joined by the new test center in Penang, Malaysia.

Última edição:

Os fundos estão disponíveis, o European Chip Act eram quase 50B, ali estão apenas 5, e fica a faltar eventualmente a FAB da Intel.

EDIT: em relação aos fundos

9 Governments Set to Fund New, Localized Chip Fabs

https://www.eetimes.com/9-governments-set-to-fund-new-localized-chip-fabs/

- China: $143 billion—China considered $143 billion in chip-industry subsidies, according to Reuters. However, Bloomberg reported in January that the plan was on hold.

- European Union: $47 billion—The EU will allocate $47 billion in government investments under the European Chips Act, which is expected to attract $16 billion in private money: $9 billion in state aid, triggering $15 billion in private investment in the IPCEI on Microelectronics and Communications Technologies. The Chips Act and IPCEI are to address semiconductor shortages and strengthen Europe’s technological leadership. The Chips Act’s goal is to double the EU’s share of the global chips market by 2030, from 10% to 20%.

- India: At least $922 million—Semicon India aims to provide financial support to companies investing in semiconductors, display manufacturing and the design ecosystem to facilitate India’s growing presence in global electronics supply chains. The program is to provide financial support of 50% of project costs to new business units or expansion/modernization/diversification of an existing unit.

- Japan: Unspecified amount of at least $6.5 billion—The Act on Promotion of Economic Security by Integrated Implementation of Economic Measures, a.k.a. the Economic Security Promotion Act, in part allocates funds for development of cloud technology, with an eye toward A.I., and supporting the semiconductor supply chain. The Japanese government hasn’t publicly said how much subsidy money it will provide. However, on June 16, Japan’s minister of economy, trade and industry said subsidies of about $391 million will be given for eight projects, including subsidies of up to $126 million to Shinko Electric Industries, a manufacturer of semiconductor package substrates, and support totaling up to around $48 million to Sakura internet for its cloud programs. In addition, TSMC’s new $8.6 billion chip fab in Japan will receive a subsidy accounting for 40% of the cost ($3.44 billion), according to a Foreign Policy Rapidus will get a subsidy worth about $2.5 billion, according to a Reuters report.

- Malaysia: Unspecified amount—Malaysia offers a range of tax and other incentives for foreign investment in manufacturing and priority sectors, such as semiconductors, according to the U.S. Congressional Research Service. The government offers companies in priority sectors a five-year, partial income tax exemption on 70% of their statutory income. Approved high technology companies in priority sectors have a full tax exemption for as long as 10 years. The government provides allowances for re-investments and many other infrastructure and related benefits tied to specific investment zones.

- Singapore: $19 billion—Minister of State for trade and industry Low Yen Ling told the Singapore Semiconductor Industry Association in July the government will invest over a five-year period in emerging semiconductor technology and R&D, in accordance with its Electronics Industry Transformation Map. In addition, Singapore is trying to entice TSMC to scrap plans to build a 12-inch wafer fab in Europe in favor of a Singaporean location, DigiTimes Asia

- South Korea: Unspecified amount—The Act on Restriction of Special Taxation focuses on tax breaks for industries that make improvements to their facilities, including semiconductor companies. Nicknamed the K-Chips Act, the legislation offers a 15% tax credit to conglomerates. Small and medium-size businesses qualify for a 25% tax credit.

Mas parece claramente uma oportunidade perdida para a GF, que poderia aqui dar o "salto", até porque aquela em particular é para os 28/22nm e 16/12nm

https://www.anandtech.com/show/18912/top-10-foundries-see-revenue-drop-nearly-15-yearoveryear

e a GF não só tem os 28nm (planar) e 14nm (FinFET) qualificados para os mercados alvo (auto e industrial) como até tinha ainda a vantagem de oferecer a alternativa ao CMOS, via "aquisição" da IBM Semi, o "FDX" (FD-SOI) que usando wafers específicas, tem como principal fornecedor os franceses da SOITEC.

https://gf.com/pull-ahead/

https://www.soitec.com/en/products/auto-fd-soi

Quer a Bosch quer a Infineon têm estado a investir bastante na sua capacidade própria mas numa vertente bastante específica, SiC (Silicon Carbide).

Infineon to build the world’s largest 200-millimeter SiC Power Fab in Kulim, Malaysia, leading to total revenue potential of about seven billion euros by the end of the decade

https://www.infineon.com/cms/en/about-infineon/press/press-releases/2023/INFXX202308-140.html

depois de terem anunciado a expansão da Fab em Dresden

Infineon kicks off new Fab in Dresden; Completion planned for 2026; Smart Power Fab will generate 1,000 new jobs

https://www.infineon.com/cms/en/about-infineon/press/press-releases/2023/INFXX202302-058.html

Rising demand for SiC chips: Bosch plans to acquire U.S. chipmaker TSI Semiconductors

26.04.2023 Press release

https://www.bosch-presse.de/presspo...-u-s-chipmaker-tsi-semiconductors-253824.html

e há dias também inciaram um novo centro de testes/acabamento na Malásia

Bosch opens new semiconductor test center for chips and sensors in Malaysia

https://www.bosch-presse.de/presspo...for-chips-and-sensors-in-malaysia-256640.html

Estes gajos da GF estão a tornar-se uma anedota, ao invés de se "afiambrarem" aos fundos da UE para investir nas FAB, vão processar o UE por atribuirem fundos a outros....

Ansatsu

Power Member

Estes gajos da GF estão a tornar-se uma anedota, ao invés de se "afiambrarem" aos fundos da UE para investir nas FAB, vão processar o UE por atribuirem fundos a outros....

Não deixa de ter alguma logica, existe reguladores para controlarem monopolizações, e no entanto é a propria UE alimentar o maior monstro que existe na area dos chips. Um dia vão estar sozinhos e depois é que vai ser ela, fazem os preços que bem lhes apetecer. Quer dizer, praticamente já fazem...